Household debt increases by the largest amount since 2007

Published November 30, 2022

Household debt rose again in the third quarter of 2022, according to the latest report from the Federal Reserve Bank of New York.

Americans are not easing their spending, even as inflation outpaces wage growth. Unfortunately, inflation causes people to spend more money to consume the same basket of goods.

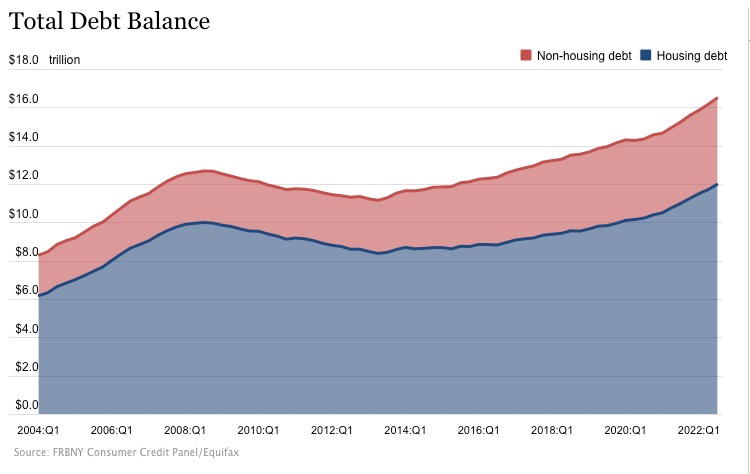

Total household debt rose 2.2% or an increase of $351 billion in the third quarter. This is the largest nominal quarterly increase since 2007. The total household debt for Americans is now $16.51 trillion.

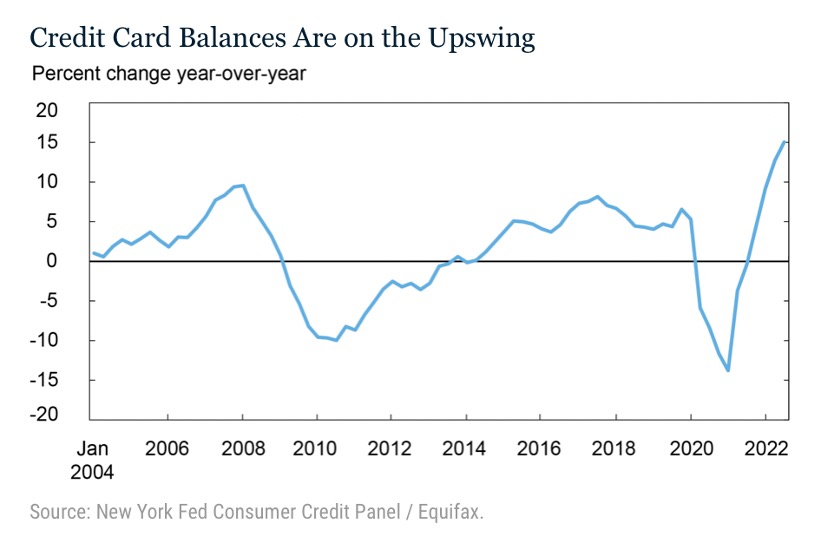

Credit card balances increased 15% annually, the largest increase in more than 20 years. This is especially concerning given that the average annual percentage rate (APR) reached its highest level since 1991. Moreover, this year saw a record increase in average APR.

Mortgage balances increased by $282 billion during the third quarter of 2022. Even so, mortgage originations declined $126 billion from the second quarter, likely due to rising interest rates and housing inflation.

With threats of a larger recession looming, the delinquency data are particularly troubling.

According to the New York Fed, “the share of current debt transitioning into delinquency increased for nearly all debt types, following two years of historically low delinquency transitions.” Even so, delinquency rates are still at historic lows.

What remains to be seen is how long this will last. Delinquency rates could be returning to pre-pandemic levels as stimulus savings disappear, but with a recession on the horizon, they will probably get much worse.

Washington took on more debt to fund its recent spending sprees, causing today’s record inflation. Now, Americans struggling to maintain their living standards with rising prices are taking on more debt.

Unfortunately, credit card debt burdens are rising more for younger and less wealthy cardholders. With APRs spiking, it will be harder to avoid delinquency. Younger borrowers, in particular, carry higher credit card balances than they did before the pandemic. The lowest-income borrowers have also surpassed their average pre-pandemic balances.

With delinquency rates on the rise, these groups will be most affected during an economic downturn. Inflation harms the poor most.

Recent spending bills have been sold to the American public as “inflation reducing” and claim to lower costs. But the truth is we cannot afford them. They are political tools that do nothing to ease inflation, and working-class Americans are paying for them.