In North Carolina, entry to nearly 1,000 professions is restricted by occupational or business licenses. Whether you dream of being a physician or a beekeeper, chances are a state licensing board remains a prominent factor for entry into your profession. North Carolina should expand its recent regulatory reforms by eliminating licensing barriers that arbitrarily stifle career entry.

Since July 1, 2024, professional privilege licenses (the state-sanctioned ability to just perform a certain profession) were no longer required for over 30 professions (except for loan agencies, pawnbrokers, and check cashing companies). While this is a step in the right direction, the state still has much to do in the way of eliminating occupational licensure’s disruption.

Many professions are licensed by the state for reasons no more justifiable than the fact that they can be licensed by the state. A 2018 brief by the Mercatus Center found that 22% of North Carolina’s workforce was licensed and another 8.4% was certified.

To list some examples of regulatory overreach:

- The North Carolina Boxing and Combat Sports Commission dictates “any person who engages in the act of announcing a match” for either mixed martial arts, boxing, or kickboxing must pay application and license fees of $75 each, with an annual renewal fee of the same price.

- A “permit required for establishments that prepare or serve drink or food for pay” must pay $120 for a new license.

- A “permit for individuals enrolling in barber school” is priced at $25.

- A licensed athletic trainer must pay application and new license fees totaling $400 with an annual renewal price of $75.

- A polygraph trainee must pay application and new license fees totaling $650 with a biennial renewal fee of $500.

- Medical doctors must pay a new license fee of $400 with an annual renewal price of $250.

- Attorneys who “Participate In Criminal And Civil Lawsuits, Prepare Legal Documents, Advise Clients As To Their Legal Rights, And Practice In Any Area Of Law” must pay application and new licensing fees totaling $1,700, with an annual renewal fee of $1,650.

Pricing of these licensing fees can span from the smallest and most frivolous of fees to thousands of dollars and can pose serious financial obstacles to new industry entrants or to new residents from other states. Occupational licensing must be reformed across the board with the elimination of state-mandated fees.

The present manner of licensure is inherently discriminatory against select professions. Why should a pawnbroker have to pay $250 to renew his annual license in perpetuity just to make his living in the manner he wishes to when an accountant, dentist, photographer, or real estate broker no longer must? Why must some professionals pay for annual renewal when others can pay once and are done?

Why must states charge professionals for licensing requirements at all?

States charge licensing fees for three reasons:

- To provide an additional revenue stream for the state budget

- To ensure that quality standards are met by industry practitioners

- To control industry entrants

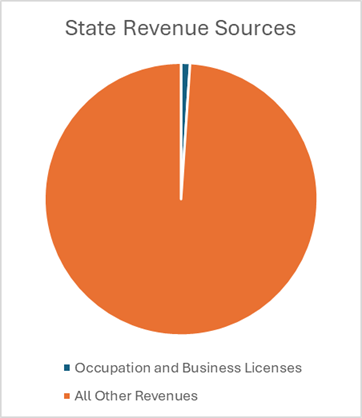

Upon closer examination, however, providing state revenue and ensuring quality fall short as justifying factors. While state collections of business and occupational licensure fees have more than tripled over the past 20 years, the impact of the licensure fees on overall state taxes is negligible. Occupation and business license fees comprised just 1% of North Carolina’s total revenues in 2024.

When it comes to ensuring a high standard of work is provided, this argument also falls short. In most cases, the market itself acts as the most adequate regulator. Consumers communicate with each other and discuss what they like and don’t like. Online review mechanisms like Yelp and social media apps are increasingly prevalent platforms in the marketplace, ones that consumers are using to eliminate the disparity in information for when they need a job done and determining who they want to do it.

Of course, not all services are equal in the risk we take on should something go wrong. Hence, it is appropriate to maintain quality service requirements for occupations like medicine, law, or architecture, whether it be exams or certifications. Nonetheless, barring circumstances where life and liberty are seriously threatened, what should count in the licensure debate is merit not money.

The truth is that business and occupational licensure is more about protectionism than consumer protection. Nobel laureate in economics Milton Friedman said it best when he argued the pressure to license an occupation “comes from members of the occupation itself” rather than the public.

Such licensing organizations most often exist to act as cartels, whereby members collude to control the number of practitioners within their industry, and, therefore, the prices they charge. This not only distorts the true value of what many of these professionals provide but also erects considerable barriers to entry for those who spent years and up to thousands of dollars on professional degrees, trade schools, certifications, or other training only to be faced with more fees as the final (or annually recurring) gateway just to get started or maintain their ability to practice. These barriers remain even more difficult to overcome if entrants come from poorer backgrounds.

FOLLOW CONNECTICUT’S DIRECTION AND GO FURTHER

All 50 states plus Washington, DC, levy fees on occupational licenses, although the size and scope vary. Nonetheless, several states have embarked on new and audacious initiatives in deregulating their state’s stringent occupational licensing practices.

In March, Connecticut Gov. Ned Lamont announced a new proposal to eliminate the application and renewal fees for selected professions in his state, primarily in the medical, trades, and teaching fields, comprising 180,000 workers. This proposal is expected to save these workers approximately $18.8 million in fiscal year 2026 and $25 million in fiscal year 2027.

While Lamont’s initiative is laudable, it is inherently discriminatory, as the Connecticut government is favoring only certain professions for this effective fee elimination.

The North Carolina General Assembly should introduce a similar bill that takes a step further in eliminating occupational license fees across the board. This will have the threefold effect of:

- Ending the effective tax on choosing and maintaining an occupation, saving North Carolina workers tens of millions of dollars per year

- Removing barriers for industry entrants and new residents in the state, strengthening jobs and North Carolina’s competitiveness

- Building an environment that is fairer and more impartial in its regulation of enterprise, promoting free market efficiency

North Carolina has the opportunity to build upon its occupational licensing reform through across-the-board fee elimination. Passing such a bill into law would implement a revolutionary change that would undoubtedly benefit the growth of jobs and strengthening of industry throughout the state. Moving in this direction offers the state economy much to gain.