Our tax system is more progressive than we thought

Published April 6, 2023

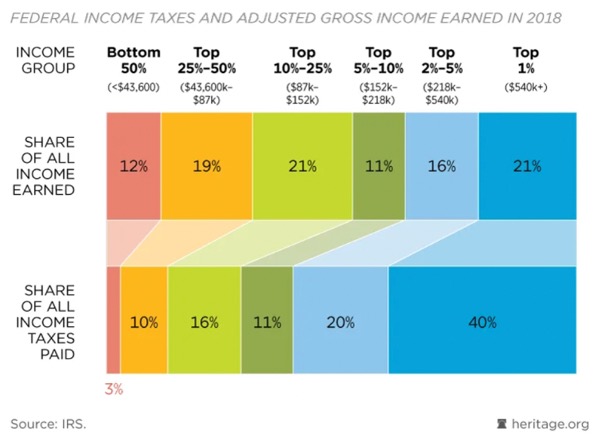

The progressive left often argues that the rich do not pay enough in taxes. The tax code is not progressive enough, they say. But, the tax code is much more progressive than they would like to admit. See the below graph from The Heritage Foundation.

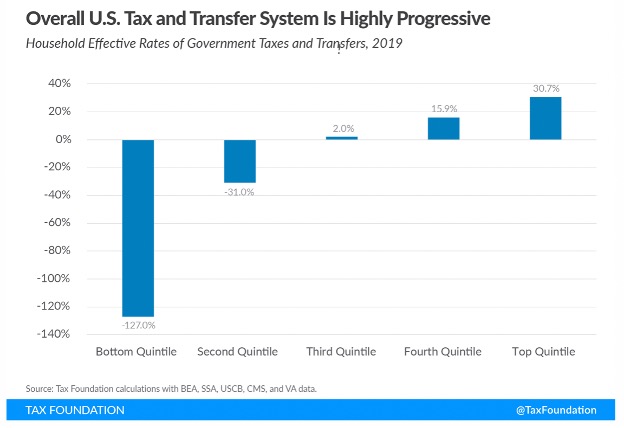

And now a new study from the Tax Foundation shows that when income transfer programs are accounted for, the overall fiscal system is even more progressive.

Transfer payment examples include Medicaid, disability, retirement, and housing services at the federal level and CHIP and unemployment at the state and local levels.

The Tax Foundation divided Americans into five groups and found that, although individuals at both ends of the spectrum pay taxes and receive government transfers (though some indirectly), for “high earners, tax liability vastly outstrips the value of benefits received, whereas for low income-earners, tax payments pale in comparison to the value of transfers received.”

For each dollar the bottom quintile earned, “they received an additional $1.27 from the government, netting transfers (gains) and taxes (losses), while the top quintile had a rate of positive 30.7 percent, meaning on net they paid just under $0.31 for every dollar earned.”

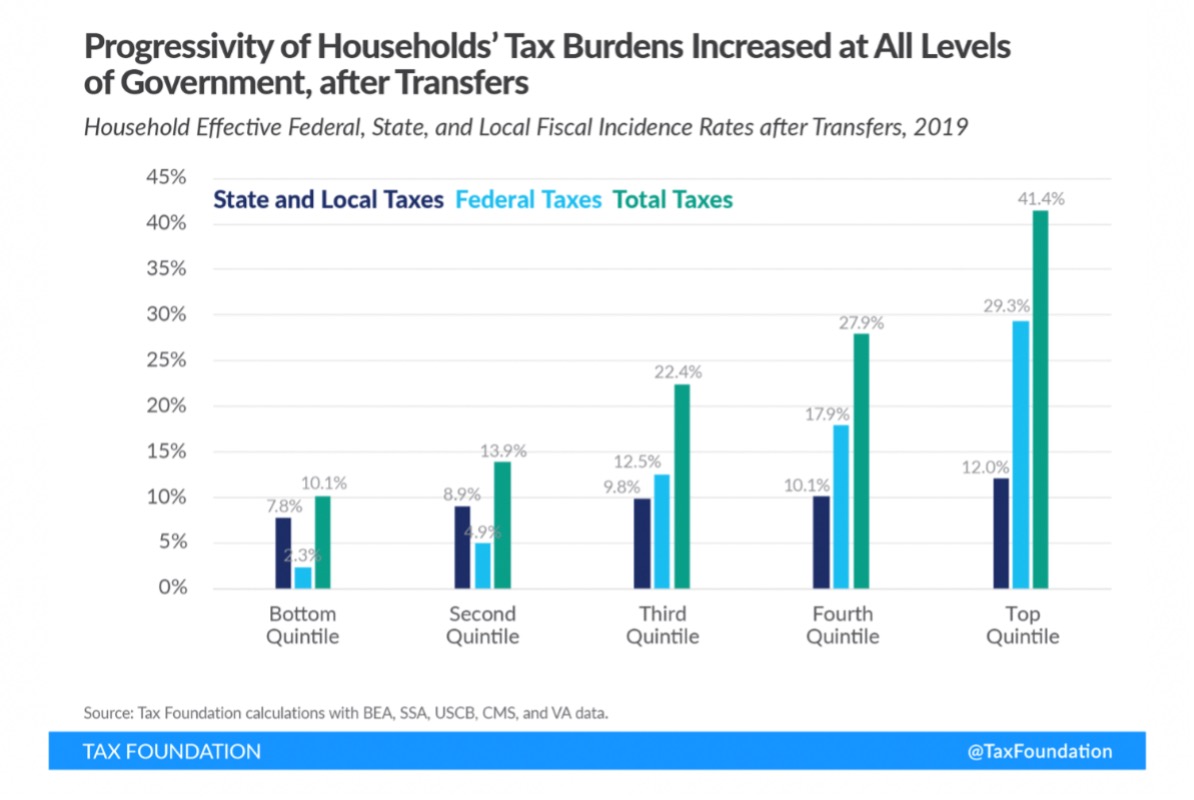

Progressivity at the federal level is found in both taxes and transfers, while progressivity at the state level comes mostly through transfers according to the study.

Once transfers are accounted for, household burdens to federal, state, and local governments are “robustly” progressive. The bottom quintile faces a rate of 10.1% while the top quintile’s effective burden is 41.4%.

Arguments in favor of making our system more progressive at any level of government are weakened by the findings of this study. In North Carolina, this study is important given the progressive push to convert our state’s income tax rate back to a multi-tiered, progressive structure.

Moreover, some are calling to put an end to the state’s corporate income tax phase-out. The Tax Foundation study found, however, that “about one-sixth of the tax burden borne by households in the lowest quintile is not personal taxes—like income, sales, and property taxes—but taxes remitted by businesses that are economically borne by taxpayers—like corporate income taxes, tariffs, severance taxes, and a variety of taxes on capital.”

Our overall tax structure is already highly progressive.