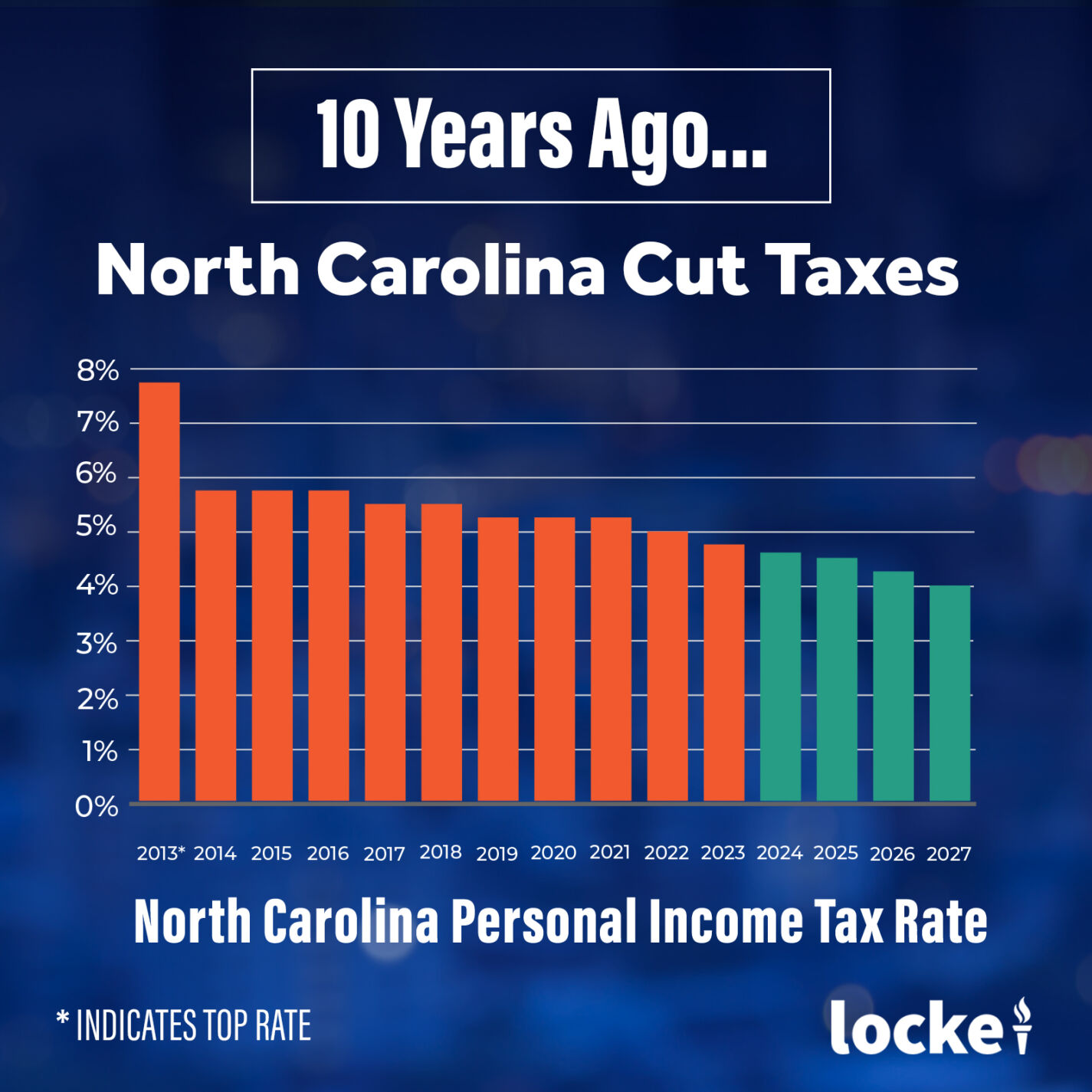

Ten years ago, in July of 2013, the Republican-led General Assembly enacted historic tax reforms. Perhaps most notably, lawmakers overhauled the state’s personal income tax, moving from a progressive multi-tiered structure to a flat, simple rate.

At the time, this simplification was groundbreaking. North Carolina was only the third state to move from a progressive to a flat rate. Today, eleven states have a flat income tax.

Before reforms, the state had three rates, ranging from 6.0 to 7.75%. The General Assembly moved the personal income rate to a flat rate of 5.75%. Everyone received a tax rate cut.

Moreover, the standard deduction more than doubled with reforms. A larger standard deduction benefits low-income families, exempting more from a state tax liability altogether.

In 2013, the General Assembly moved the standard deduction from $3,000 to $7,500 for single filers and from $6,000 to $15,000 for married filing jointly. Further reforms have additionally expanded the standard deduction to $12,750 for single filers and $25,500 for married filing jointly. Since 2013, the standard deduction has increased by 325%.

The personal income tax made up 56% of state General Fund tax fund revenue in FY 2013. Now, even with the cuts, the personal income tax makes up 54% of revenue.

With bold tax reforms, North Carolinians have more disposable income. This is important because money belongs to the individual who earns it. Aside from paying the taxes to fund core functions of government, your money belongs in your pocket.

In a limited government, tax burdens should be low. When government spending increases, taxpayer burdens necessarily increase. Thanks to fiscal restraint, the conservative General Assembly in 2013 made dramatic reforms to lower the taxpayer burden. In the last decade, they have built on those reforms, further incentivizing work and allowing you to keep more of your hard-earned money.