Ned Barnett, associate opinion editor of the Charlotte Observer and the News & Observer of Raleigh, recently published an article highlighting the main points presented in a new report by the left-wing NC Budget & Tax Center.

According to Barnett, the report “shows how much NC loses — and how little you gain — from GOP tax cuts.”

But does the report really show that?

First off, when claiming that “NC loses” from the tax cuts, what Barnett means is state government has less revenue than it supposedly would have without the tax cuts. Even that basic claim is disputable, because it’s not a given that higher tax rates generate more tax revenue.

The report itself is chock-full of dubious presumptions and misleading claims.

For starters, the report claims that “Over the past decade, state leaders have repeatedly prioritized tax cuts for the wealthiest households and most profitable corporations.”

This statement is misleading on several fronts. First, personal tax rates have been lowered on all income earners, not just the “wealthiest households.” Prior to tax reform that began in 2013, North Carolina’s tax rates ranged from a low of 6% to a high of 7.75%, with rates progressively rising with income.

As of 2026, there is one flat tax rate of 3.99% levied on income above the standard deduction. This means that rates even on the lowest income earners were reduced by a third.

Moreover, the standard deduction has more than doubled since 2013, climbing from $7,500 for single filers to $15,750 and from $15,000 for married filing jointly to $31,500. The aggressive increase in the standard deduction means many more low-income North Carolina households owe zero state income taxes.

But the Budget & Tax Center ignores these very real forms of tax relief for low-income workers.

The report also wants to demonize the “most profitable corporations” as beneficiaries of reductions to the state corporate income tax, while not mentioning that the majority of the benefits from corporate tax cuts go to workers.

Also ignored is the fact that most small businesses file taxes subject to the personal income tax rate, and therefore those tax cuts provided relief to small businesses.

Moving on, the Budget & Tax Center report declares that the tax rate reductions “have significantly reduced state revenue.”

That also is not true.

From FY 2011-12 (the last fiscal year before the 2013 tax cuts) and FY 2024-25, total state tax revenue increased by 77.7%. During that time, population growth plus inflation was about 53%. In short, not only did the tax reforms over the past decade plus not “significantly reduce state revenue,” state tax revenue grew at a significantly faster pace than inflation plus population.

Indeed, the revenue growth rate for North Carolina’s three major taxes combined (personal, corporate, and sales) grew at a much faster rate in the decade following the 2013 tax cuts compared with the decade preceding the cuts.

Furthermore, predictions of massive budget shortfalls due to tax cuts from critics like those at the Budget & Tax Center have been a near annual event since 2013. And those predictions have been woefully wrong.

Backing out the COVID year, North Carolina has experienced more than $12.6 billion in surpluses in the 10 years following the 2013 tax cuts — a time critics were insisting that tax cuts would produce dramatic shortfalls.

Additionally, the Budget & Tax Center report, ignoring the fact that revenues have risen significantly while tax cuts have continued, warns that “cutting revenue actually limits the state’s ability to lower costs in meaningful ways.

“It’s public investment — in these sectors of our state’s economy — that makes everyday life more affordable,” the report continues, adding that “[h]ousing, child care, and health care costs continue to rise faster than wages for many workers.”

It is assumed the center wrote this unironically, despite the fact that housing, health care, and child care already have some of the most aggressive government programs to make them affordable.

Not only does government not make goods or services affordable, the very opposite seems to be true. History suggests that perhaps the surest way to make a good or service rise in price dramatically is to have government efforts to make it “affordable.”

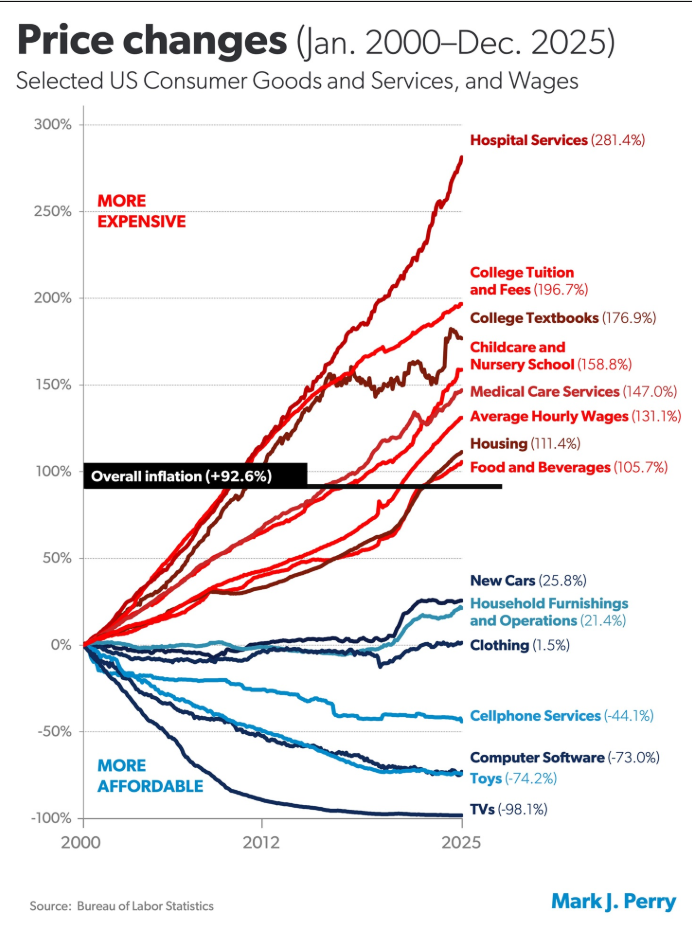

Economist Mark Perry regularly updates his “chart of the century,” which shows the price changes of selected goods and services over time. Even a quick glance will reveal a pattern: those items rising in price at the fastest rate have significant government programs to make them affordable, while those actually becoming more affordable have no such programs. Yet again, the Budget & Tax Center is way off base when warning that a (nonexistent) decrease in state revenue will restrict the government’s ability to make things “affordable.”

Finally, a critical point that Barnett and the Budget & Tax folks ignore is how North Carolina’s economy has benefited from steady tax-rate reductions.

North Carolina is rated as the best state to do business by CNBC. A report last year from the North Carolina Department of Commerce showed that North Carolina reduced its poverty rate at the fifth-fastest pace in the country in the decade following the 2013 tax cuts.

And the steady drumbeat of tax cuts of the past dozen years continues to pay dividends.

From 2018 to 2024 (most recent data available), North Carolina’s per-capita income grew at an average annual rate of 5.9%, coming in higher than the national average and highest among its neighbors. Also, North Carolina’s GDP grew at an average annual rate of 2.95%, higher than the US average and behind only Tennessee (which has no income tax) among its neighbors. And during that time, North Carolina’s real GDP increased a total of 16.5%, also higher than the national average and second only to Tennessee among its neighbors.

The Budget & Tax Center unfortunately continues its baseless fearmongering about tax cuts while presenting misleading arguments and leaving out critical details.

Their misdiagnosing the problem will naturally lead to recommendations that are at minimum off-base and at worst will make the problems worse still. Any advice coming from them should be firmly rejected

Brian Balfour is the John Locke Foundation's senior vice president of research